Mastering the Art of Ecommerce Payment Processing: An In-Depth Handbook

Introduction

In the rapidly evolving world of ecommerce, the ability to process payments efficiently and securely is fundamental to the success of any online business. As online shopping becomes the norm, mastering payment processing can distinguish successful ecommerce ventures from those that struggle. This comprehensive handbook delves into the intricacies of ecommerce payment processing, exploring various methods, best practices, security measures, and future trends.

Understanding Ecommerce Payment Processing

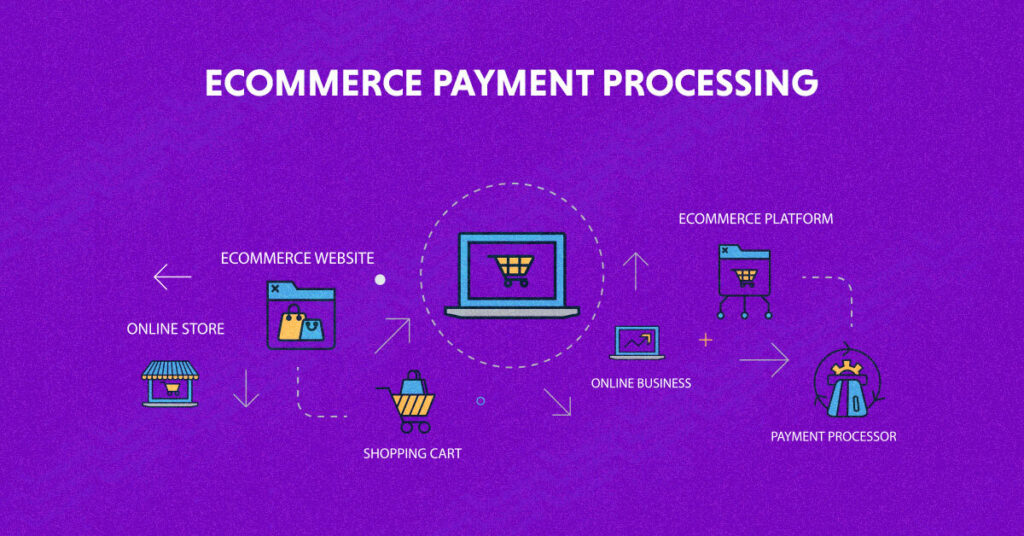

Ecommerce payment processing involves a series of steps that allow customers to complete their purchases online. It encompasses everything from the moment a customer decides to buy a product to the point where the funds are transferred to the merchant’s account. This process is not just a backend operation; it’s a crucial element that affects user experience, conversion rates, and customer satisfaction.

Key Components of Payment Processing

- Payment Gateway: A payment gateway is a service that authorizes credit card or direct payments for online retailers. It acts as a bridge between the ecommerce site and the bank, ensuring that sensitive data is transmitted securely.

- Merchant Account: This is a type of bank account that allows businesses to accept payments, typically through credit or debit cards. It is essential for processing card transactions.

- Payment Processor: A payment processor handles the transaction between the customer, the merchant, and the bank. They manage the authorization and settlement processes.

- Shopping Cart: The software that enables customers to select products, review their choices, and proceed to checkout. Many ecommerce platforms integrate payment processing directly into their shopping cart systems.

- Security Protocols: Various standards and protocols, like PCI DSS (Payment Card Industry Data Security Standard), ensure that payment transactions are secure, protecting sensitive customer information.

Types of Payment Methods

Ecommerce businesses must offer a variety of payment options to cater to different customer preferences. Here are the most common types of payment methods:

1. Credit and Debit Cards

These are the most widely used payment methods in ecommerce. Credit cards allow customers to purchase products on credit, while debit cards withdraw funds directly from the customer’s bank account.

2. Digital Wallets

Services like PayPal, Apple Pay, Google Pay, and others have gained immense popularity due to their convenience. Customers can store their payment information securely and make transactions quickly.

3. Bank Transfers

Direct bank transfers, including ACH (Automated Clearing House) payments, are becoming more common, especially for larger transactions. They offer low transaction fees but can take longer to process.

4. Buy Now, Pay Later (BNPL)

BNPL services, such as Klarna and Afterpay, allow customers to purchase items and pay for them in installments. This method has gained traction, particularly among younger shoppers.

5. Cryptocurrency

With the rise of digital currencies like Bitcoin and Ethereum, some ecommerce businesses are beginning to accept cryptocurrency as a form of payment. This method appeals to tech-savvy consumers but comes with volatility risks.

6. Mobile Payments

Mobile payment options, which allow customers to make purchases using their smartphones, are growing in popularity. NFC (Near Field Communication) technology facilitates quick transactions in physical stores and online.

Choosing the Right Payment Processor

Selecting a payment processor is one of the most critical decisions an ecommerce business can make. Factors to consider include:

1. Fees

Payment processors charge various fees, including transaction fees, monthly fees, and chargeback fees. It’s essential to compare costs across different providers to find the best fit for your business model.

2. Security

Security should be a top priority. Look for processors that comply with PCI DSS and offer advanced fraud detection tools.

3. Integration

Choose a payment processor that seamlessly integrates with your ecommerce platform and shopping cart software. This ensures a smooth checkout experience for customers.

4. Customer Support

Reliable customer support is crucial, especially during peak business hours or when technical issues arise. Evaluate the support channels available, such as live chat, email, and phone support.

5. International Capabilities

If you plan to sell globally, ensure your payment processor supports multiple currencies and payment methods used in different countries.

Best Practices for Ecommerce Payment Processing

Implementing best practices can enhance the payment experience for customers and reduce the likelihood of fraud and chargebacks.

1. Simplify the Checkout Process

A lengthy or complicated checkout process can lead to cart abandonment. Aim for a streamlined checkout that requires minimal steps and information. Implement features like guest checkout and auto-fill forms to improve the user experience.

2. Offer Multiple Payment Options

As mentioned earlier, providing various payment methods can cater to different customer preferences and increase conversion rates. Always keep an eye on emerging payment trends to stay competitive.

3. Ensure Mobile Optimization

With a significant portion of ecommerce traffic coming from mobile devices, ensure your payment processing is optimized for mobile. This includes having a responsive design and mobile-friendly payment options.

4. Use SSL Encryption

Secure Sockets Layer (SSL) encryption is vital for protecting customer data during transactions. Ensure your website has an SSL certificate to encrypt sensitive information.

5. Implement Strong Fraud Prevention Measures

Utilize fraud detection tools and services to identify and mitigate fraudulent transactions. These may include address verification services (AVS), card verification value (CVV) checks, and machine learning algorithms to assess transaction risk.

6. Educate Customers on Security

Reassure customers about the security measures you have in place. Display trust seals, SSL certification badges, and clear privacy policies to build confidence.

Compliance and Legal Considerations

Ecommerce businesses must adhere to various legal and regulatory requirements related to payment processing.

1. PCI Compliance

The Payment Card Industry Data Security Standard (PCI DSS) outlines security measures that businesses must follow to protect cardholder data. Compliance is mandatory for any business that accepts credit card payments.

2. Data Protection Regulations

Familiarize yourself with data protection regulations such as GDPR (General Data Protection Regulation) in Europe and CCPA (California Consumer Privacy Act) in the U.S. These laws govern how businesses collect, store, and process personal information.

3. Tax Compliance

Ensure you understand the tax implications of your ecommerce transactions. This includes sales tax collection in various jurisdictions, especially if you sell across state or country borders.

Future Trends in Ecommerce Payment Processing

As technology continues to evolve, so does the landscape of ecommerce payment processing. Staying ahead of trends can give your business a competitive advantage.

1. Artificial Intelligence and Machine Learning

AI and machine learning are transforming payment processing by enhancing fraud detection, personalizing customer experiences, and automating routine tasks.

2. Voice Commerce

With the rise of smart speakers and voice-activated devices, voice commerce is set to become a significant player in ecommerce. Optimizing payment processing for voice transactions can position your business favorably.

3. Contactless Payments

The demand for contactless payment options has surged, particularly post-pandemic. Investing in technologies that facilitate touch-free transactions will likely pay off.

4. Enhanced Cryptocurrency Acceptance

As cryptocurrencies gain mainstream acceptance, ecommerce businesses may benefit from integrating cryptocurrency payment options. This can attract a new segment of tech-savvy customers.

5. Subscription and Recurring Payments

As more businesses adopt subscription models, payment processors will need to offer robust solutions for managing recurring billing and payments.

Conclusion

Mastering ecommerce payment processing is essential for the success of any online business. By understanding the key components, choosing the right payment methods, implementing best practices, and staying informed about future trends, businesses can create a seamless and secure payment experience for their customers. With the ecommerce landscape continually evolving, being proactive and adaptive is the key to thriving in the digital marketplace.

Leave a Reply